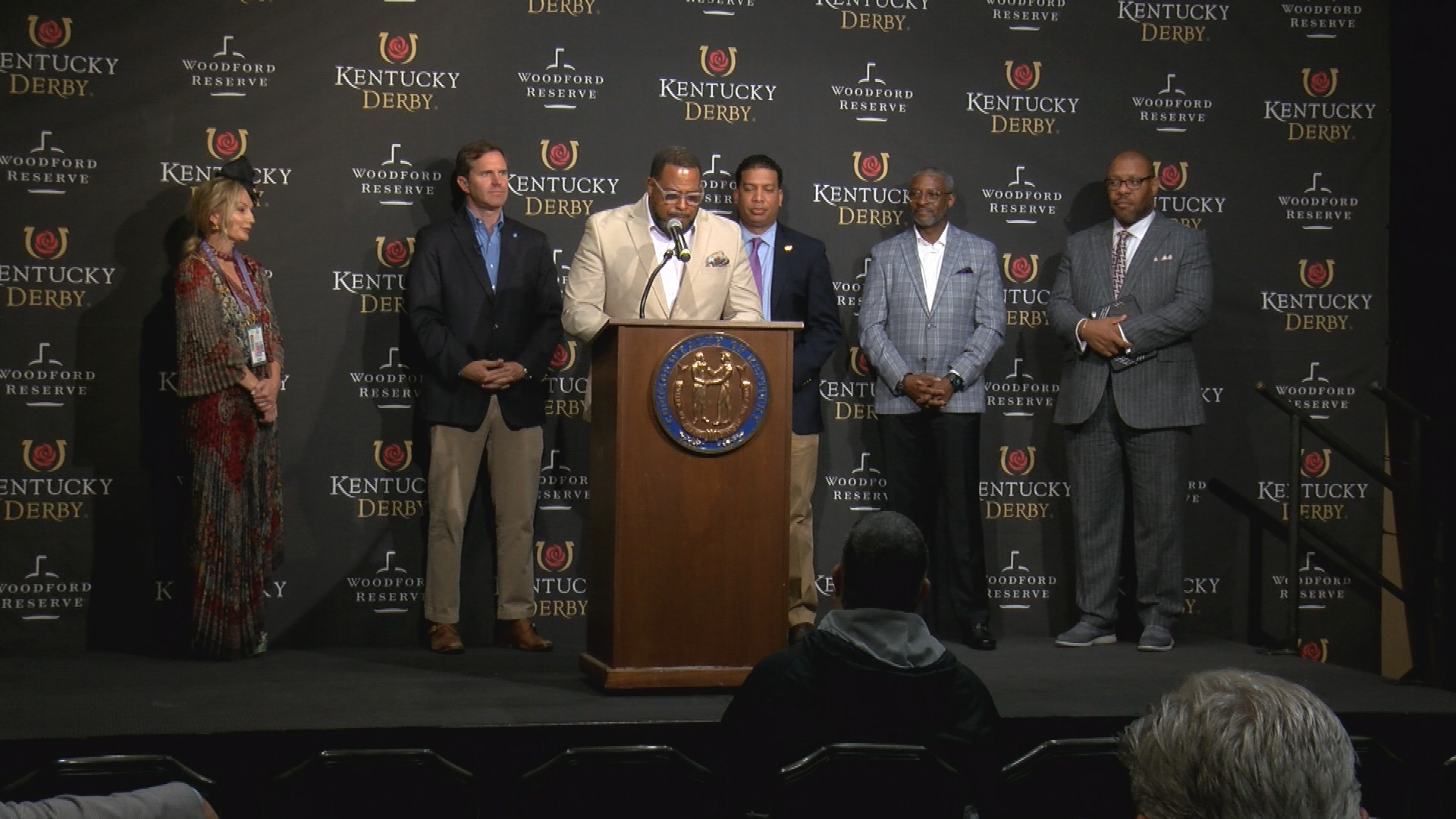

Rich Strike Wins the 148th Running of the Kentucky Derby Presented by Woodford Reserve at 80-1 Odds

LOUISVILLE, KY., (May 7, 2022) – Churchill Downs Incorporated (“CDI”) (Nasdaq: CHDN) announced today that an exuberant crowd of 147,294 Derby fans at Churchill Downs Racetrack (“Churchill Downs”) witnessed the second-biggest long shot ever to win the Kentucky Derby as Rich Strike claimed an unexpected victory at the 148th running of the Kentucky Derby presented by Woodford Reserve at 80-1 odds. CDI also announced that wagering from all-sources was the highest all-time on the Kentucky Derby race, the Kentucky Derby Day program and Kentucky Derby Week races.

Wagering from all-sources on the Kentucky Derby Day program totaled $273.8 million, a 17% increase over 2021 and up 9% from the previous record in 2019 of $250.9 million. Wagering from all-sources on the Kentucky Derby race totaled $179.0 million, up 15% over 2021 and up 8% from the previous record of $166.5 million set in 2019. This year’s wagering record includes $8.3 million of handle wagered in Japan.

Rich Strike, owned by Richard Dawson’s RED TR-Racing and bred in Kentucky by Calumet Farm rallied to win by 3/4 of a length. Trained by Eric Reed and ridden by Sonny Leon, Rich Strike covered the mile and a quarter in 2:02.61 over a fast track and produced an upset second only to Donerail’s triumph at 91-1 in 1913.

BUSINESS COMMENTARY

“We are deeply grateful to all of the fans of the Kentucky Derby around the world who once again made this an amazing and memorable experience,” said Bill Carstanjen, CEO of CDI. “We expect the Kentucky Derby Week Adjusted EBITDA to reflect another record with $7 to $9 million of growth over the prior record in 2019.”

TWINSPIRES

TwinSpires, the official betting partner of the Kentucky Derby, handled $67.4 million in wagering on Churchill Downs races for the Kentucky Derby Day program, an increase of 8% over the previous record in 2021. TwinSpires’ handle on the Kentucky Derby race was $44 million, up 8% over last year’s record.

DERBY WEEK

All-sources handle for Derby Week rose to a new record of $391.8 million, up 25% from 2021 and up 14% from the previous record of $343.0 million set in 2019.

Use of Non-GAAP Measures

In addition to the results provided in accordance with GAAP, the Company also uses non-GAAP measures, including adjusted net income, adjusted diluted EPS, EBITDA (earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA.

The Company uses non-GAAP measures as a key performance measure of the results of operations for purposes of evaluating performance internally. These measures facilitate comparison of operating performance between periods and help investors to better understand the operating results of the Company by excluding certain items that may not be indicative of the Company’s core business or operating results. The Company believes the use of these measures enables management and investors to evaluate and compare, from period to period, the Company’s operating performance in a meaningful and consistent manner. The non-GAAP measures are a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP, and should not be considered as an alternative to, or more meaningful than, net income or diluted EPS (as determined in accordance with GAAP) as a measure of our operating results.

We use Adjusted EBITDA to evaluate segment performance, develop strategy and allocate resources. We utilize the Adjusted EBITDA metric to provide a more accurate measure of our core operating results and enable management and investors to evaluate and compare from period to period our operating performance in a meaningful and consistent manner. Adjusted EBITDA should not be considered as an alternative to operating income as an indicator of performance, as an alternative to cash flows from operating activities as a measure of liquidity, or as an alternative to any other measure provided in accordance with GAAP. Our calculation of Adjusted EBITDA may be different from the calculation used by other companies and, therefore, comparability may be limited.

Adjusted net income and adjusted diluted EPS exclude discontinued operations net income or loss; net income or loss attributable to noncontrolling interest; changes in fair value for interest rate swaps related to Rivers Des Plaines; Rivers Des Plaines’ legal reserves and transaction costs; transaction expense, which includes acquisition and disposition related charges, as well as legal, accounting, and other deal-related expense; pre-opening expense; and certain other gains, charges, recoveries, and expenses.

Adjusted EBITDA includes the Company’s portion of EBITDA from our equity investments.

Adjusted EBITDA excludes:

- Transaction expense, net which includes:

- Acquisition, disposition, and land sale related charges;

- Direct online Sports and Casino business exit costs; and

- Other transaction expense, including legal, accounting, and other deal-related expense;

- Stock-based compensation expense;

- Rivers Des Plaines’ impact on our investments in unconsolidated affiliates from:

- The impact of changes in fair value of interest rate swaps; and

- Legal reserves and transaction costs;

- Asset impairments;

- Legal reserves;

- Pre-opening expense; and

- Other charges, recoveries and expenses.

As of December 31, 2021, Arlington ceased racing and simulcast operations given the pending sale of the property to the Chicago Bears. Arlington’s operating loss in the current year quarter was treated as an adjustment to EBITDA and is included in other Other expenses, net in the Reconciliation of Comprehensive Income to Adjusted EBITDA.

For segment reporting, Adjusted EBITDA includes intercompany revenue and expense totals that are eliminated in the consolidated statements of comprehensive income. Refer to the Reconciliation of Comprehensive Income to Adjusted EBITDA included herewith for additional information.

Press Contacts

Nick Zangari

Vice President, Treasury, Investor

Relations & Risk Management

Phone: (502) 394-1157

Email: [email protected]